Learn all about Form 8689 and its implications for tax compliance. This comprehensive guide covers key aspects, FAQs, and expert insights to help you navigate tax obligations seamlessly.

Introduction

Navigating the intricate landscape of tax regulations is a crucial responsibility for every individual and business entity. Form 8689, also known as the “Allocation of Individual Income Tax to the U.S. Virgin Islands,” plays a significant role in ensuring proper tax compliance. In this guide, we delve into the details of Form 8689, its purpose, application, and how it affects taxpayers. Whether you’re a resident of the U.S. Virgin Islands or have income sources there, understanding Form 8689 is essential to fulfilling your tax obligations accurately.

Form 8689: Understanding the Basics

Form 8689 is a tax document designed to allocate individual income tax to the U.S. Virgin Islands. It’s a unique form primarily applicable to taxpayers who are residents of the U.S. Virgin Islands or have income generated from this territory. This form ensures that the tax liabilities are appropriately assigned and accounted for between the U.S. mainland and the U.S. Virgin Islands.

The Significance of Form 8689

Form 8689 serves a pivotal role in preventing double taxation and ensuring that taxpayers are taxed fairly based on their income sources. It helps in determining the exact portion of income subject to tax in the U.S. Virgin Islands, which is often subject to different tax rates and regulations compared to the U.S. mainland.

Key Points to Remember

When dealing with Form 8689, there are several key aspects to keep in mind:

- Residency Requirements: To be eligible to use Form 8689, you must meet the residency requirements of the U.S. Virgin Islands. This generally involves maintaining a physical presence in the territory for a specific period.

- Income Allocation: The form requires you to accurately allocate your income between the U.S. Virgin Islands and other locations. This allocation ensures that you’re not overpaying or underpaying your taxes.

- Tax Credits: Form 8689 also considers any tax credits you might be eligible for, both in the U.S. Virgin Islands and on the mainland. These credits can significantly impact your overall tax liability.

Exploring Form 8689 in Detail

Completing Form 8689 Step by Step

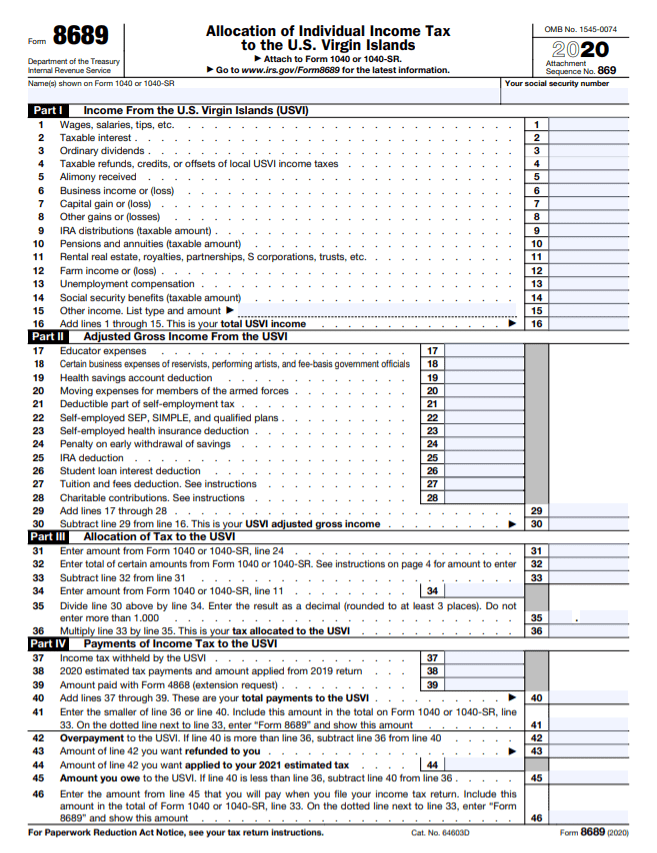

Filling out Form 8689 might seem daunting at first, but breaking it down into steps can simplify the process. Here’s a step-by-step guide:

- Provide Personal Information: Begin by entering your personal details, including your name, Social Security Number, and address.

- Specify Residency Status: Indicate whether you are a bona fide resident of the U.S. Virgin Islands or if you’re claiming presence-based residency.

- Income Allocation: Enter the necessary income details and allocate them between the U.S. Virgin Islands and other locations. This often involves dividing your income based on the source or nature of the earnings.

- Calculate Tax Liability: Calculate your tax liability separately for the U.S. Virgin Islands and the mainland. This step considers different tax rates and deductions applicable to each location.

- Claim Tax Credits: If you’re eligible for any tax credits, make sure to claim them accurately on the form. These credits can reduce your overall tax liability.

- Attach Supporting Documents: Depending on your income sources and deductions, you might need to attach supporting documents to substantiate your claims.

Common FAQs About Form 8689

Can I e-file Form 8689?

Yes, you can e-file Form 8689 using approved tax software or through authorized tax professionals. E-filing offers convenience and ensures faster processing of your tax return.

What’s the Deadline for Filing Form 8689?

The deadline for filing Form 8689 is usually aligned with the regular tax filing deadline, which is April 15th. However, extensions might be available if needed.

Do I Need to Attach Form 8689 to My Federal Return?

Yes, if you’re filing a federal tax return, you should attach Form 8689 to provide details of your income allocation and tax liability.

Can Form 8689 Be Used for Corporate Income?

No, Form 8689 is designed for individual taxpayers and is not applicable to corporate income.

Are There Penalties for Incorrectly Filing Form 8689?

Yes, incorrect or incomplete filing of Form 8689 can lead to penalties. It’s essential to ensure accurate reporting to avoid potential issues.

Can I Amend Form 8689 if I Made a Mistake?

Yes, if you realize you made a mistake on Form 8689 after filing, you can file an amended return using Form 1040X.

Exploring the Implications of Form 8689

Tax Benefits for U.S. Virgin Islands Residents

One of the primary advantages of Form 8689 is that it offers tax benefits for residents of the U.S. Virgin Islands. As a U.S. territory, the U.S. Virgin Islands has its own tax laws and regulations. By correctly allocating your income on Form 8689, you can take advantage of potentially lower tax rates and deductions specific to the territory. This can lead to significant tax savings, making it essential for residents to understand the intricacies of this form.

Impacts on Tax Planning and Strategy

Form 8689 has far-reaching implications on tax planning and strategy, especially for individuals and businesses with income sources in both the U.S. Virgin Islands and the mainland. Careful income allocation can help optimize your tax liability, allowing you to strategically allocate income to minimize your overall tax burden. This requires a comprehensive understanding of both U.S. Virgin Islands tax laws and federal tax regulations.

Avoiding Double Taxation

Double taxation, where the same income is taxed by both the U.S. Virgin Islands and the U.S. mainland, can be a concern for many taxpayers. Form 8689 plays a critical role in preventing such scenarios by ensuring that income is appropriately assigned to its respective tax jurisdiction. This helps in eliminating the risk of paying taxes twice on the same income, saving taxpayers from undue financial strain.

Importance for Non-Residents with U.S. Virgin Islands Income

Form 8689 isn’t exclusive to U.S. Virgin Islands residents; it’s equally relevant for individuals who earn income within the territory but don’t reside there. If you have income generated from the U.S. Virgin Islands, accurately completing Form 8689 ensures that your tax liability is accurately calculated based on your income source. Non-residents should consult tax professionals familiar with both U.S. mainland and U.S. Virgin Islands tax laws to ensure proper compliance.

The Simplified Path to Tax Compliance with Form 8689

Expert Assistance: Navigating Complexity with Ease

Navigating the complexities of Form 8689 can be overwhelming, especially for individuals without a background in tax law. Seeking the guidance of tax professionals experienced in U.S. Virgin Islands tax regulations can provide peace of mind. These experts can help you accurately allocate your income, claim eligible tax credits, and ensure that your tax return is filed correctly and on time.

Online Resources: Accessible Information at Your Fingertips

In the digital age, access to accurate information is more convenient than ever. Numerous online resources provide detailed insights into Form 8689, including step-by-step guides and frequently asked questions. Government websites, tax preparation software, and reputable financial websites offer a wealth of information to assist taxpayers in understanding and correctly completing Form 8689.

Staying Updated: Adapting to Changing Regulations

Tax laws and regulations are subject to change, and Form 8689 is no exception. To ensure compliance and accurate reporting, it’s essential to stay updated on any modifications to the form’s requirements. Subscribing to tax news updates, following official IRS communications, and consulting tax professionals regularly can help you stay informed about changes that could affect your tax obligations.

FAQs About Form 8689

Can I File Form 8689 Electronically if I Reside in the U.S. Virgin Islands?

Yes, residents of the U.S. Virgin Islands can often file their tax returns electronically through the Virgin Islands Bureau of Internal Revenue’s online portal.

What If My Income Sources Are Complex and Span Multiple Locations?

In cases of complex income sources, seeking professional tax advice is highly recommended. Tax professionals can ensure accurate income allocation and compliance with tax regulations.

Is Form 8689 Required Every Year?

If you meet the criteria for filing Form 8689, you’ll generally need to file it each year to accurately report your income allocation and fulfill your tax obligations.

Can I Claim Foreign Tax Credits on Form 8689?

Yes, individuals who qualify for foreign tax credits can claim them on Form 8689. These credits can help offset your tax liability on income allocated to the U.S. Virgin Islands.

Is Form 8689 Subject to Audits?

Like other tax forms, Form 8689 is subject to IRS audits. It’s crucial to maintain accurate records and documentation to support your income allocation and tax credits claimed.

Can I Consult Tax Professionals for Form 8689 Even if I Have Experience with Taxes?

Absolutely. Form 8689’s unique nature and implications warrant professional advice to ensure accurate reporting and compliance with territorial and federal tax laws.

Conclusion

Form 8689 holds significant importance for taxpayers with income connections to the U.S. Virgin Islands. By accurately completing this form, individuals and businesses can navigate tax compliance smoothly, optimize their tax strategies, and avoid the pitfalls of double taxation. Understanding the nuances of Form 8689 empowers taxpayers to fulfill their obligations while harnessing potential tax benefits offered by the U.S. Virgin Islands tax system.

Remember, while this guide provides valuable insights, individual circumstances may vary. For personalized advice and accurate filing, consulting a tax professional is always a prudent step. By staying informed and proactive, you can navigate the complexities of Form 8689 with confidence.